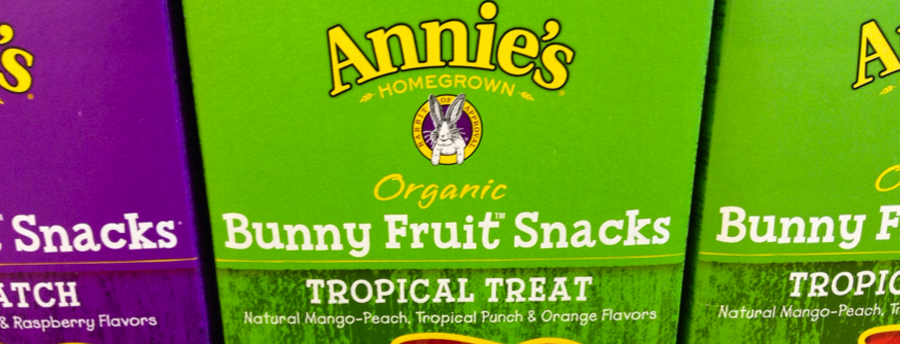

With the current healthy-eating mindsets that more and more consumers have adopted the nutrition facts will become more important in marketing products. While brand loyalty, intriguing designs, and famous names may still dictate the power-players in the food industry, nutrition is becoming more prevalent in a consumers’ purchase decision. If a product doesn’t fulfill the healthy expectations of today’s consumers, that brand risks rejection in favor of smaller, clearly healthier brands. Health food marketing is changing.

How did we get here?

The year is 1990 and The Nutrition Labeling and Education Act is put into effect, giving the FDA the power to have companies spell-out nutrition information. Designed by Burkey Belser, the infamous, black-and-white design was then featured on almost every food package in the country. Consumers would see exactly what they were consuming so many were swayed away from unhealthy products. Usually hidden on the back, the label was almost an after-thought. It was something that the companies had to incorporate but did not really want to people to see.

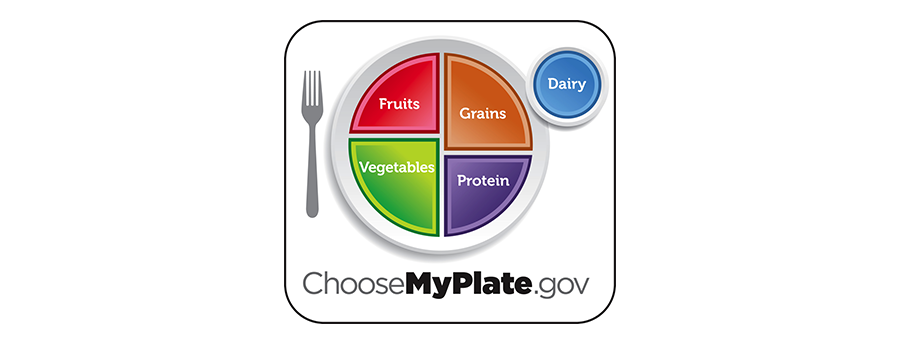

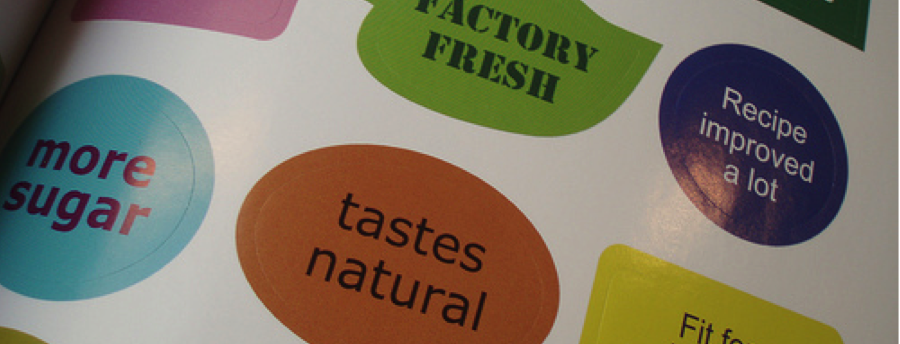

The year is 2011 and the FDA began an initiative, dubbed Facts Up Front. It migrated the important nutrient information from the dreary, hidden shadows of the back of packaging to the front. According to the official website, it highlights key features of the labels but companies are also encouraged to highlight other nutrients that they feel represent their product well.

General Mills is one of the more notable brands to embrace the initiative and also one of the first (though over 50 companies have also displayed Facts Up Front). Proudly displaying all the wholesome ingredients in their products and boasting about their whole grains has undoubtedly placed them ahead of competitors who do not choose to share. Others in health food marketing need to act accordingly.

The momentum is starting to shift. Some companies are even starting to showcase their beneficial and healthy stats via front label. What was once considered a marketing and design nightmare by many is now being used as an opportunity to positively sell a product. Thanks to Facts Up Front, along with the healthy-eating craze, companies that once served unhealthy foods are being forced to look at their ingredients- a bonus for health-minded consumers.

So what does the future have in store for health food marketing? We will very likely see the nutrition information become even more dominant. Maybe it will be highlighted in bright color, bold in strong fonts, and prominently placed in prime retail package space- no matter how it gets displayed, the nutrition facts’ day to shine has finally arrived and the consumer is sure to follow.